Understanding Credit Scores: Why They Matter and How to Improve Them

A credit score is a numerical representation of an individual's creditworthiness. It's calculated based on a person's credit history and helps lenders and financial institutions determine how risky it is to lend money to them.

The most widely used credit score is the FICO score, which ranges from 300 to 850. A score of 700 or higher is generally considered a good credit score, while a score below 600 is considered poor.

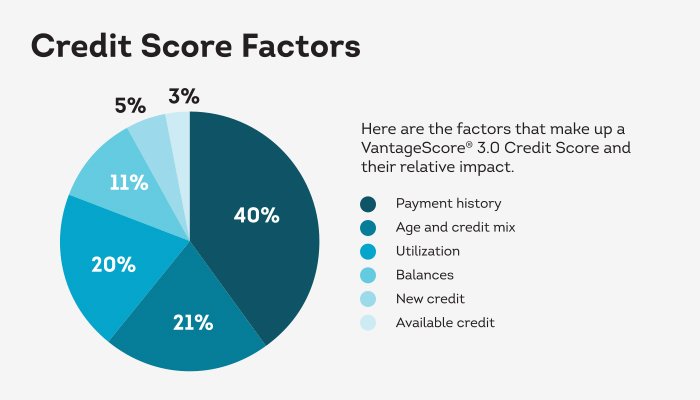

Here is a visual representation of the factors that make up a credit score. Imaged sourced from here.

Maintaining a high credit score is beneficial for several reasons. First, it can help you qualify for loans and credit cards with better interest rates and terms, saving you money over time. Second, a high credit score can also make it easier to rent an apartment, get approved for a job, or obtain insurance. On the other hand, a low credit score can make it challenging to get approved for credit, and if you do get approved, you may have to pay higher interest rates and fees. Additionally, a low credit score can also hurt your chances of getting hired for certain jobs or getting approved for an apartment or rental property. Overall, maintaining a high credit score is an essential part of managing your financial health and can help you achieve your financial goals. Improving your credit score takes time, but you can gradually raise your score and improve your financial health.

Here are several ways you can work to improve your credit score:

Pay your bills on time: Late or missed payments can have a significant impact on your credit score. Make sure you pay all your bills on time, including credit card payments, loan payments, and utility bills.

Keep your credit utilization low: Your credit utilization is the amount of credit you're using compared to your credit limit. Ideally, you should keep your credit utilization below 30%. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300.

Check your credit report for errors: Mistakes on your credit report can negatively impact your credit score. Check your credit report regularly and dispute any errors you find.

Avoid opening too many new credit accounts: Applying for too much credit at once can lower your credit score. Be selective when applying for credit and only apply for what you need.

Maintain a long credit history: The length of your credit history can also impact your credit score. The longer you've had credit accounts in good standing, the better.

Don't close old credit accounts: Closing old credit accounts can also hurt your credit score, especially if you have a long credit history. Keep your old credit accounts open and use them occasionally to keep them active.

In conclusion, maintaining a high credit score is crucial for your financial health. A good credit score can help you qualify for loans and credit cards with better terms and interest rates, making it easier for you to achieve your financial goals. To improve your credit score, you should pay your bills on time, keep your credit utilization low, check your credit report for errors, avoid opening too many new credit accounts, maintain a long credit history, and avoid closing old credit accounts. By following these tips, you can gradually raise your credit score and enjoy the benefits of good credit.